Page 51 - demo

P. 51

On longer flights, premium fares can be so CEO Bjorn Kjos often reminds analysts and

profitable they subsidize the rest of the aircraft, travelers he’s not going away.

allowing full-service carriers to match prices

without materially hurting profitability. And now And he might be right. Though Norwegian Air

that many legacy airlines sell a no-frills product ranked 74th on Airline Weekly’s list of the world’s

that roughly matches a discounter’s product 75 most profitable airlines between mid-2017 and

attributes — U.S. airlines call it basic economy mid-2018, the carrier performed reasonably well

— they’re even better at price matching. last summer, producing roughly $156 million in

profit between July and September.

“If they are doing a great job in the front of bus

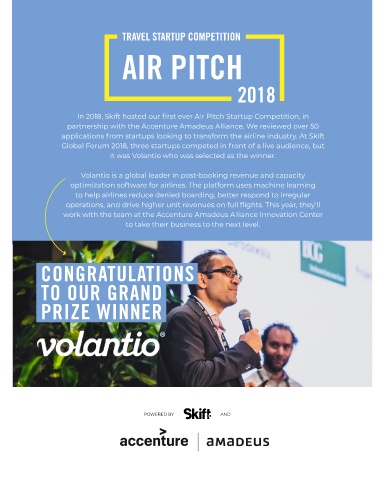

making half their revenue on 15 percent of these Then again, most airlines can make money flying In 2018, Skift hosted our first ever Air Pitch Startup Competition, in

seats, it will allow them to price their economy very transatlantic routes in summer, when demand is partnership with the Accenture Amadeus Alliance. We reviewed over 50

aggressively,” Skúli Mogensen, Wow Air’s founder robust. Winter is tougher, and O’Leary of Ryanair,

and CEO, said in an interview in September. “I which was No. 1 on that Airline Weekly list, has applications from startups looking to transform the airline industry. At Skift

have been impressed. The U.S. carriers at large said he’s not sure Norwegian will survive. Global Forum 2018, three startups competed in front of a live audience, but

have been far more aggressive in applying the it was Volantio who was selected as the winner.

low-cost model, segmenting the seat structure, “We expect more failures this winter,” O’Leary,

understanding the passenger, adding ancillary a longtime rival of Kjos’, said in the fall. “Mostly,

revenue, adding technology.” we think one of the two Scandinavian airlines.” Volantio is a global leader in post-booking revenue and capacity

optimization software for airlines. The platform uses machine learning

There are other issues with the long-haul, O’Leary has said similar things before, and Norwe- to help airlines reduce denied boarding, better respond to irregular

low-cost model. gian keeps chugging along. But if something

goes wrong, Norwegian might choose a soft operations, and drive higher unit revenues on full flights. This year, they’ll

Over the past four decades, low-cost, short-haul landing and sell the company. British Airways work with the team at the Accenture Amadeus Alliance Innovation Center

airlines have perfected how they turn airplanes, owner International Airlines Group, or IAG, to take their business to the next level.

ensuring little ground time. But they lose much expressed interest in Norwegian for much of last

of that advantage when each plane flies just two year, though the airline’s board has rebuffed it.

segments a day. Other full-service carriers could be interested, too.

“When a Southwest or a Ryanair plane is on the Even if they disappear, low-cost transatlantic

ground f ive, six, or maybe seven times a day, airlines have proven consumer behavior has CONGRATULATIONS

that quicker aircraft turnaround time — 10 or 15 changed. Once, legacy carriers assumed custom-

minutes faster than a legacy competitor — that ers wanted a bundled experience for long-haul

adds up to hours of additional flying during the flights, with seat assignments, baggage, and TO OUR GRAND

day,” said Seth Kaplan, managing partner of food and drink included.

Skift’s Airline Weekly newsletter. PRIZE WINNER

Now, they have gotten the message. Most sell

Then there are different demand patterns. It is unbundled fares, a trend that likely will contin-

not unusual for low-cost, short-haul airlines to ue, and some have created their own low-fare

offer outrageous pricing, like nearly $0 fares, airlines that roughly mimic Norwegian. And while

plus fees. Those fares can stimulate demand and most are defensive enterprises meant to keep

persuade people to travel more than they other- the parent company f rom losing share, some

wise might. But while $500 round trips between may keep flying no matter what happens with

the United States and Europe are a good deal, the competition.

they’re not the type of fares that can get people

off the couch and onto a plane.

Not Going Away

While it’s tempting to pronounce the low-cost, POWERED BY AND

long-haul model dead already, Norwegian Air

46 Skift